4 Ways to Successfully Appeal Your Property Taxes

Property values seem to be rapidly increasing during this housing boom we are experiencing. And while that’s great when trying to sell your house, it’s not so great when it comes to paying your property taxes. But don’t lose hope – there are ways to appeal to get your property taxes lowered. Here is what you need to know to successfully appeal your bill and pay less moving forward.

Property values seem to be rapidly increasing during this housing boom we are experiencing. And while that’s great when trying to sell your house, it’s not so great when it comes to paying your property taxes. But don’t lose hope – there are ways to appeal to get your property taxes lowered. Here is what you need to know to successfully appeal your bill and pay less moving forward.

Understand Your Property Value

Your property tax bill is based on the assessed value of your house. However, the assessed value is not the same as the market value. The market value is what your home might sell for, based on factors like size and positive/negative attributes, location, supply and demand and what other homes around it are selling for. The assessed value is determined by looking at the sales prices of similar nearby properties to arrive at an initial value for your home. Then they deduct any tax exemptions that you qualify for. Finally, that number is multiplied by a set percentage rate (also known as an assessment rate or assessment ratio) to calculate the final assessed value of the property. If your home’s value looks low on your assessment, it is because that assessed value is only a fraction of the full market value.

Correct Any Incorrect Property Information

Your assessed value is based on the property information that the assessor’s office has on file. They use things like total square footage, number of bedrooms and bathrooms, finished living space and more to determine the value of your property. Our attorneys can request a copy of the internal notes and data the assessor is using, to confirm that the information is accurate, and that they have compared your home to other homes of similar size, age, etc. when determining your home’s value. The most accurate assessments take all of this information into account, and a successful appeal is often won due to misinformation or improper home comparisons.

Act Fast

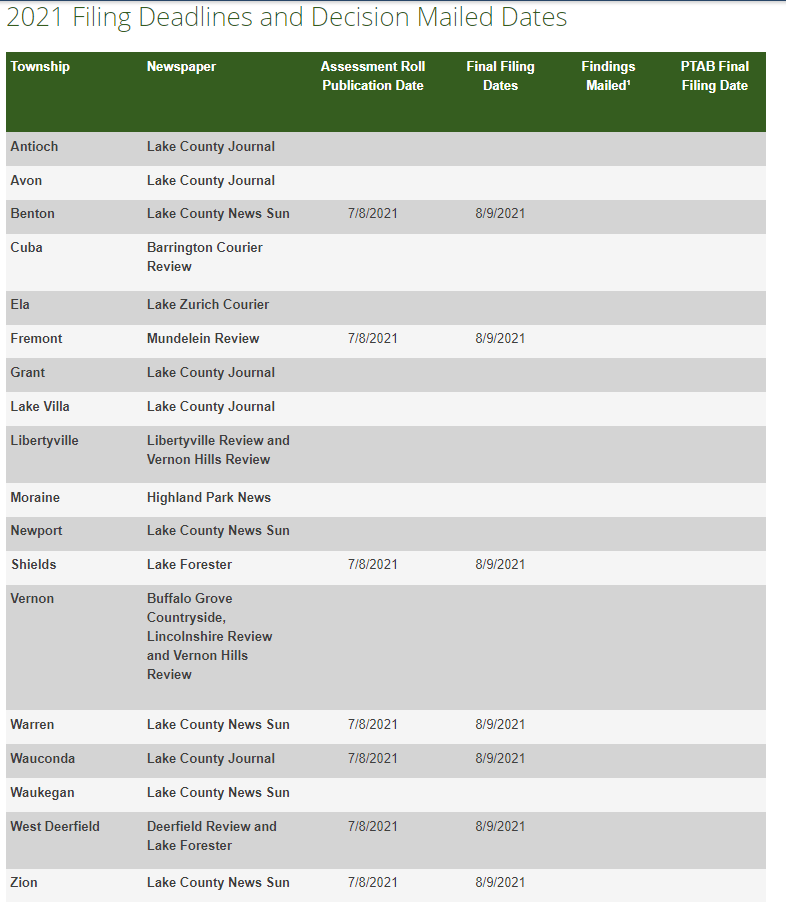

When it comes to appealing your property taxes, timing is everything. There are certain appeal deadline dates that must be met, according to the township your property is located in. If you miss the deadline, there is nothing you can do until next year. That being said, here is a list of dates to follow, as listed on the Lake County Tax Assessor website. Not all dates have been designated yet, but visit their site regularly HERE for updated information. As of July 7, 2021, the deadlines are as follows:

Work With the Right Attorney

There are many details to consider during the tax appeal process and even if you present a good case, the assessor does not have to agree with you. In fact, they will often do their best to defend their original estimate. However, a qualified attorney can make a significant difference in a successful appeal.

The attorneys at Churchill, Quinn, Richtman & Hamilton, Ltd in Grayslake are experienced in reducing real estate tax liability and we have an extremely high success rate when it comes to saving our clients money. We will provide a free initial evaluation to determine if an appeal is warranted – and will not charge any fee unless we successfully reduce your taxes. Contact us at 847-223-1500 to learn more or to schedule your consultation.